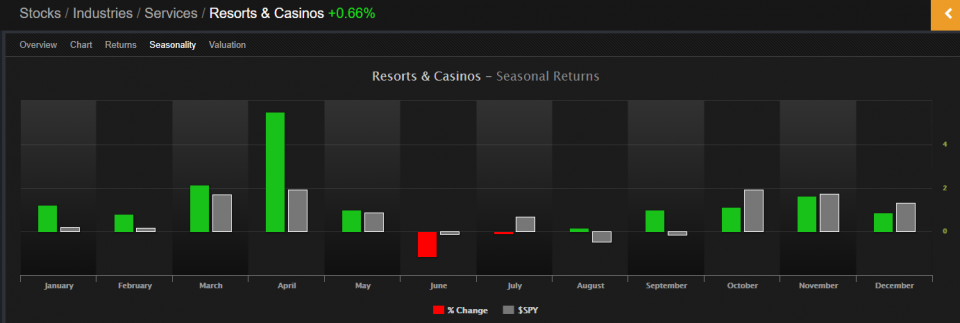

It’s hard to believe that we are nearing the end of Q1 2019. It’s time to reevaluate our trade plan as well as begin formulating our strategy to get off to a strong Q2. Each year around this time I make sure to have at least some exposure to the Resorts and Casinos group. Using Exodus Market Intelligence and the seasonality study shows why:

April is a stellar month for the Resorts and Casinos as a group. Stocks include the usual suspects like LVS, WYNN, PENN, BYD, and MGM. In my case, I had some money to put to work in my IRA which I tend to be more conservative with. Instead of taking an individual stock here I am going to add some calls in BJK, an ETF which does a decent job in representing these names.

You know me well enough to understand that I would never trade based on seasonality alone. We need to have multiple factors lining up for me to risk capital. I believe we have that if you will take a look at a chart of BJK with me:

Do you see the makings of a familiar reversal pattern? I believe I do and want to be here to take advantage of it.

I’ll be back soon with a recap of what went right and what went wrong thus far in 2019 and some other ideas to get your Q2 off to a good start.

Trent J. Smalley, CMT