We successfully made it two days into the new decade before geopolitical news made waves throughout the world and the global marketplace. On Thursday evening, news that the U.S. had eliminated Major General Qasem Soleimani in a successful airstrike hit the wires. The killing of Iran’s most powerful general sent crude oil futures higher in Friday’s session and equity indexes lower. Stocks on the whole were mixed as investors mulled the news headlines and braced themselves for possible retaliatory measures.

I’m not an expert on geopolitical tension and I don’t pretend to be. I wish for the safety of U.S. troops and our allies and hope that damage can be kept to a minimum. What I can do is spot fund flows as they happen in real time and find ways to profit from them in both the short and longer term. In a tumultuous situation like we had last week, the first place I look is the Aerospace and Defense Industry Group. As expected, stocks in this sector rose on Friday. The two major ETFs of this group (Blackrock’s ITA and State Street’s XAR) rallied into the close of trading on Friday in preparation for the possibility of more threats to come. The chart below shows these ETFs in comparison with the SPX:

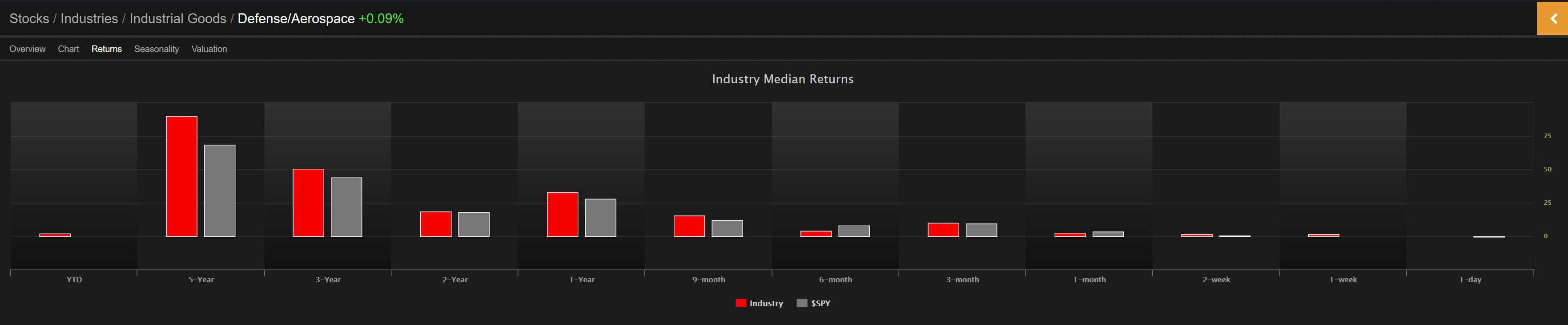

ITA is just off of all time highs while XAR made new all time highs on Friday. A comparison of this group and the SPY over the past 5 years shows that over the long term is has paid to be overweight aerospace and defense stocks:

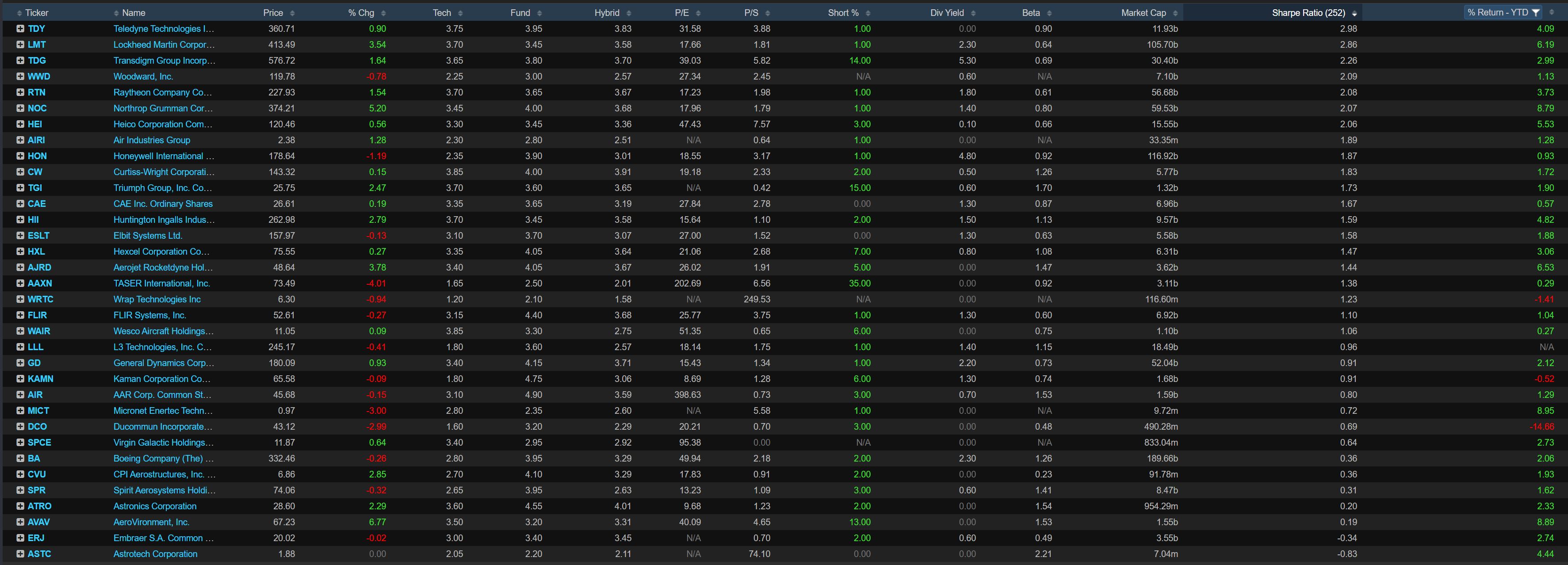

That being said, if you have no exposure to this group, an ETF is a fine play especially if you think the tensions will continue to rise. If you’d rather try and pick a few individual stocks from the group, I organized a list based on Sharpe Ratio thanks to Exodus Market Intelligence:

If there is no immediate escalation before the market opens tomorrow, I would expect a pullback in these names giving you a better opportunity for entry. If further tensions arise this evening you can expect the majority of these stocks to continue rallying throughout tomorrow’s session.

Trent J. Smalley, CMT