Understanding Brexit, what it entails, its risks, and its opportunities.

It was an interesting week which ought to go down for many as a time for reflection. The potential of what can happen in an overbought / overpriced market is probably a bit clearer now. Since we’ve talked a lot about the endogenous factors that make the markets vulnerable at the moment, it probably is time to talk about some of the exogenous forces that may make a bad situation worse. Chief amongst those is Brexit and to fully understand what is going on a trip back in time is necessary to explain the details of what was and what has now become the European project, why have the British voted the way that they have and what is the likelihood of Brexit being the beginning of the end for the EU. Please bear with me, it is important to get the full picture here.

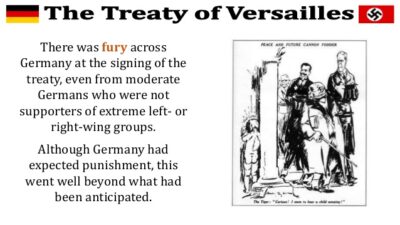

Some 100 years ago upon the termination of WWI a “peace” treaty was concluded, the Treaty of Versailles. As it always happens after a major armed conflict, victors dictated the outcomes at the end of the War and some of them had particularly harsh implications on the losers.

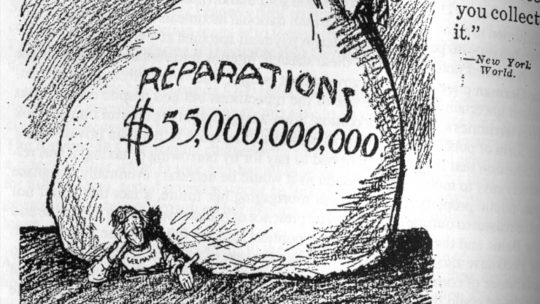

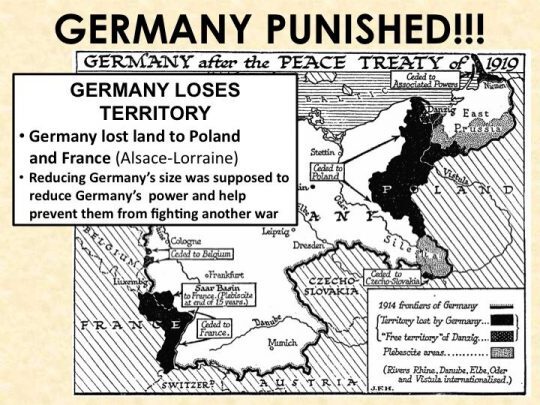

As one of the defeated countries, Germany was obliged to pay France 132 billion Reich marks as War reparations in addition to making many territorial concessions to both France and Poland. This burdened Germany to the point that the country badly struggled economically even as the roaring ‘20ies unfolded and then completely collapsed during the 1930ies depression. The failure of the Weimar Republic generated a vacuum of political power that was ultimately filled by adolf hitler’s nazis. A tragedy of monumental proportions, as we all know, ensued for Europe and in fact for the entire World.

At the end of WWII a different approach was taken. People understood that the war reparations scheme at the end of WWI had the 2nd European conflict virtually baked in the cake. The Nurnberg trial dealt largely with the tragedy of the Holocaust and all other atrocities committed by the nazis. To rebuild the continent after the ruinous War, two choices were made. The first was the Marshall Plan whereas the US invested large sums of money in the Western European economies in an attempt to both extend American influence and to counter that of the Soviets. The second was called the France – Germany steel and coal commission established in 1951 which later on in 1952 was also embraced by Italy, Belgium, Netherlands and Luxembourg – and thus renamed European Coal and Steel Commission. People figured that democratic nation states that trade with each other are less likely to engage in destructive war and because coal mining and steel production were the biggest sectors of the post-war European economies, economic integration started there.

In 1957, thereafter, the scope of the free trade agreement between France and Germany was extended to include all industries. Six countries became signatory to the Treaty of Rome – France, Germany, Italy, Belgium, Luxembourg and the Netherlands – which officially sanctioned the beginning of what was called the European Economic Community.

In 1973 the UK government opted into the EEC. Brits subsequently voted 67% Yes in a referendum in 1975 which asked them the question “Do you agree for the United Kingdom to be part of the free trade zone area called European Economic Community”.

These ideas were obviously noble and sensible and the logical thing to do. But the European project got hijacked and derailed starting in 1992 with the treaty of Masstricht. Beyond the Maastricht moment the Brussels bosses became obsessed with concepts such as monetary union and ultimately forced political union.

We can easily argue both sides of the debate regarding the merits of a European Federal state. Some would say it would be a United States of Europe in which nation states ultimately morph into a common European identity and live in total harmony. My view on this is that the comparison with the United States of America, where different federal subjects share nevertheless a language, a common American identity and the DESIRE to be a nation stands in very sharp contrast to Europe, where many of the federal subjects have very different cultures and languages, are subject to asymmetric levels of development, and, perhaps most importantly, LACK THE DESIRE to be a common European nation. If Europe will get there it will be after moving in the right direction for a minimum of 70-100 years.

I am convinced all European nations want to have a Europe of limited borders and great economic, cultural, and scientific cooperation. But I am also convinced nobody wants a European federation in which the sovereignty of nation states is abolished, nobody really wants a European flag, a European anthem or the European Court of Justice jurisdiction over their country’s legal system. When people in Denmark or Ireland rejected such ideas in referendums, they were bullied into voting again till they “approved” needed changes. When people rejected the adoption of the European Constitution in referendums in France and Netherlands, new treaties achieving the exact same things were forced through the back door. By stealth and deception, without ever telling the truth to any of the European peoples Brussels attempted to force the formation of a federal state structure NOBODY WANTED. And go figure, at times EU bureaucrats actually bragged about treating democracy with deliberate contempt in their attempt to bulldoze nation states and create the United States of Europe superstructure. Just google Jean Claude Juncker quotes and you’ll see what I mean.

This brings us more or less where we are today. Modern Europe is no longer a great and noble economic integration project born out of the ashes of WWII to bring stability and development to European peoples. Modern Europe is now envisioned by the political elites as a perverted model of forced political integration and artificial federalization whose sole purpose is giving more power and control to the political establishment. One of the main consequences of this process – and very few people are aware of this – is the mechanism embodied by the European Commission. On one hand the European Commission is supposed to be the executive branch of the EU government. But the Commission is also the SOLE EU body empowered with the ability to issue binding legislation that becomes compulsory for all the 28 member states. This is a blatant violation of the principles of democratic governance whereas the legislative branch of the government should be different from the executive and the judicial one. Moreover, please have a look at the “process” – if that’s what we can call that charade – by which Jean Claude Juncker got “elected” a couple of years ago as EU Commission President: secret vote in the European parliament in a contest that had ONE SINGLE CANDIDATE, I mean they couldn’t make this thing up could they! Clearly, the political stitch ups are too much and there is an enormous concentration of UNELECTED POWER in the hands of a few Brussels insiders whose orders come from the European / Transatlantic political establishment and not from the peoples of Europe. Major policy mistakes ranging from the directive regarding refugee quotas which is known to have created major social problems for many member states; to double standard industrial, financial, energy and agriculture policies favoring some nations at the expense of others have lead to massive divisions within countries and between countries and a massive collapse of EU popularity on the European continent.

In 2016 the majority of the British people have voted to exit the EU in a national referendum that saw a record 72% voter turnout. Brussels has nothing but bullied the UK ever since, surely with the full support of a rather treasonous British political class. The British PM, perhaps the worst in the history of the country and a remainer herself, is busier making backroom deals that would lead to Brexit in name only than ensuring the democratic, sovereign will of the British people to part ways with the EU is fully implemented. The fanaticism of European federalists is achieving almost religion status and in the process democracy is being totally crushed. I do not believe the country that invented parliamentary democracy, the UK, will stand for it and I believe the silent majority will eventually rise.

I told you all these things to tell you this. The UK has DEMOCRATICALLY CHOSEN a path to national self determination and will not be bullied into staying in. A sensible approach would have been to negotiate some sort of EU – UK deal and avoid a disruptive economic event. But Brussels is worried that in doing so they would invite further waves of “secession”. Ultimately, this political power play between those that seek to establish a European super state by force and those standing for nation state democracies is likely to have catastrophic economic consequences. A no deal situation is not ideal for the UK but it will be nothing short of terrible for the EU for at least two reasons:

- European businesses, from Belgium chocolate and French wine producers, to Spanish tourist resorts, to German motorcar manufacturers and even groups like Airbus would lose their biggest export market and important links in complex supply chains. The UK will endure great pain but will end up finding substitutes in most cases after a number of years. For the EU it will be way more difficult to do the same, in part, ironically, due to the fact that the artificial construction of the Euro stimulates export competitiveness in Germany but suppresses it almost everywhere else in the EU.

- Most EURO denominated OTC credit derivatives volumes are traded in London (credit default swaps, forward rate agreements and interest rate swaps). The infrastructure is much too complex to be relocated overnight in places like Frankfurt or Paris. A no deal situation will threaten to implode EURO denominated credit markets because even if the ECB deals with the liquidity part of the equation they cannot replace the mechanism by which interest rate risk is shared and hedged by EU businesses and financial institutions. In rejecting a UK deal, the EU may in fact inflict a credit crisis 2.0 enhanced upon itself. Perhaps the best analogy I can find in real life is a joke they have in my native Romania: you’re not particularly bright if you chainsaw the tree branch you sit on!

What I fear is that the focus of the EU bosses is on preserving their beloved political union without fully understanding the implications of their actions. The political union at this point is very unlikely to survive as euro skeptic movements are beginning to surface even in Germany. And dismantling the political union would actually be a good thing. But if the EU disappeared as an economic structure and not only as a political one, the consequences will be beyond disruptive. The US will probably have some safe-haven status during the event and will fare much better than a lot of other places around the world but ultimately the spillover would take place on a global scale. The trade to do, at least in the initial stage, of an eventual EU disintegration will be long US and short Europe and probably Asia.

Do keep in mind that this Brexit situation unfolds while bearish patterns are seen all over the European and pan-European stock indices:

In addition, do keep in mind that the RS lines of Italian and Spanish stock markets versus the German one are sitting at truly oversold and depressed levels and are due for a bounce. The only way we’d have a bounce in those ratios was if the economic union aspect of the EU was being challenged, which is what will likely happen when the Brexit-in-name will ultimately backfire – which I am sure is the higher probability event! So I think that in getting freaked out about the Brexit resolution the market has gotten a thing or two right here……

[/vc_column_text][/vc_column][/vc_row][vc_row el_id=”PATTERN ANALYSIS”][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row][vc_row el_id=”PATTERN ANALYSIS”][vc_column][vc_column_text]

Pattern Analysis

S&P 500 Index

The momentum condition following last week’s collapse means upside should be limited to corrective bounces for now. Resistances come in at 2780-99 and then 2850 and further losses towards 2677 – 2696 and eventually below are the higher probability event.

S&P 400 Index

Price patterns and momentum currently suggest we’re looking at an incomplete decline. Unless we push back above the 1918 / 1938 key resistances the trouble for the mid caps should continue at least until they touch the 1823 / 1772 area.

S&P 600 Index

Likewise the small caps should run into a wall of resistance around 985 / 1011 / 1035 and should continue their descent towards 938 / 913 and eventually 883.

Dow Industrials

Dow Industrials

The picture in the DJIA is almost identical with that in the SPX. We’re looking at corrective bounces to be repelled within the 25,752 / 26,157 range and to be followed by more weakness towards 24,600 / 24,263 / 24, 006

Nasdaq 100 Index

The bounce we’ve started late last week should be a correction that stalls somewhere within the 7162 – 7314 range. It should subsequently lead to a move to new lows into the 6,720-6,848 and possibly the 6,549-6,610 support range.

[/vc_column_text][/vc_column][/vc_row][vc_row el_id=”STOCK PICKS”][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row][vc_row el_id=”STOCK PICKS”][vc_column][vc_column_text]

WEEKLY STOCK PICKS

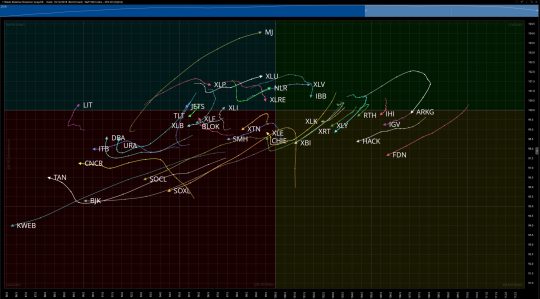

After a week of heavy volatility, we were reminded of the importance of risk management. Caution should always be taken to protect capital, but in these conditions, less is more. I want this week’s list to be the top 5 stocks, instead of the top 10 to urge this theme. As volatility comes back into the market, implied volatility in the options market spikes. Due to this you are paying more for option premium, especially those positions which are out of the money. You will notice in this week’s top 5, that in the money premium is taken more frequently. Included also this week is a Relative Rotation Graph. This is a technical tool we use to get a bird’s eye view of sectors and industry groups of interest and their relative strength with respect to the SPX and each other. If you have questions about how to read these graphs just reach out and I’ll be happy to help.

ALB

| DIRECTION | BUY ZONE | SELL ZONE | RISK/REWARD | VEHICLE |

| UP | 95-96 | 102-103 | MIN/+8 | OPTIONS |

ALB is part of the $LIT ETF which from the RRG you can see is moving into the improving (top left) quadrant. Oftentimes when industry groups begin moving from the lower left quadrant to the upper left, we begin seeing fund flows into these areas, strengthening them further. The stock also is wedging into the VPOC on the one year daily which also coincides with the 61.8% Fibonacci Retracement from the low to the high made in 2018. With a confluence of support beneath, a wedge pattern, and being part of a strengthening industry group as shown by the weekly RRG, I want to get long ALB via November options. Decide whether the 95 or 100 strike fits your objectives and look to make a move early in the week. They will report earnings prior to the expiry of the calls so make sure to set an alert.

GBLX

GBLX

| DIRECTION | BUY ZONE | SELL ZONE | RISK/REWARD | VEHICLE |

| UP | .30-.35 | .85-.90 | -.5/.50 | STOCK |

Even in the scariest of moments last week, nothing was more apparent than the strength of the cannabis stocks. The $MJ ETF has moved into the leading quadrant as we see investors build out baskets of stocks exposing them to this viable long term growth area. While it is difficult to pick a favorite, as I have been an advocate of allocating small amounts of capital to about 10 or so OTC names, I like how $GBLX is setup. After a major run up at the end of 2017, GBLX has spent the majority of this year working its way lower. Most recently, it has broken out above the long termflagging pattern and come back to retest the breakout point which is just above the one year VPOC level. RSI has been putting in lower lows as well signaling momentum strength. Add this one to your list of cannabis OTC names if you haven’t already.

SLB

| DIRECTION | BUY ZONE | SELL ZONE | RISK/REWARD | VEHICLE |

| UP | 58.80-60 | 65+ | -.75/6.00 | OPTIONS |

SLB has been trading in a falling wedge pattern throughout 2018, despite the rally in crude oil. I don’t believe this continues much longer and it is possible we’ve seen the lows in SLB for some time. Thursday and Friday this past week we can see the bulls defending lower as evidenced by the longer lower shadows on the daily candles. The stock had been in a short term up trend until the market sell off this past week interrupted its progress higher. As the market stabilizes I think SLB resumes higher and current prices are a gift to get long. We have a bullish momentum divergence in our favor here as well. Like most stocks, the IV is elevated so ITM options are the preferred play here.

CDAY

CDAY

| DIRECTION | BUY ZONE | SELL ZONE | RISK/REWARD | VEHICLE |

| UP | 34-36 | 45-46 | -2/10 | OPTIONS |

CDAY has the broadening pattern look to it and last week’s market turmoil sent the stock to the midrange. We know from experience that there are two levels from which we like to get long in these patterns; the bottom bound and the midpoint. Generally, my preference is to get long the stock at the midrange ½ size of my intended position, leaving room to add should it come down to the lower boundary. CDAY is a member of the internet software and services industry group which is oversold to a level not seen in the past year as a whole. I expect a swift snapback in many of the names in this group, CDAY included. Exodus Market Intelligence provided the Oscillator below:

VKTX

| DIRECTION | BUY ZONE | SELL ZONE | RISK/REWARD | VEHICLE |

| UP | 13.50-14.50 | 19.50-20 | -1.00/5.00 | STOCK |

Twice in the past year, VRTX biotech has gapped up on heavy volume. It isn’t very often when stocks gap up on that volume that they fill that gap as the probable institutional buyers provide strong support lower. I had my eye on this stock before the most recent gap higher but missed it. As it has wedged back down into levels where that buyer support should do its job holding the price from falling further. I’ll be looking at stock on any pullback early in the week.