WEEKLY LETTER END OF MAY 2019

Welcome back!

I hope you all had a nice long holiday weekend. As you are aware, the past 4-6 weeks have proved to be an especially difficult swing trading environment. The global markets have been hostage to headline risk and what some yet to be penned technical analysis textbooks will someday call “Tweet Risk” as World leaders insist on keeping the spotlight on themselves. China trade tensions are the Tweet Risk de jour and while I am not a Global Macro expert, I am an expert when it comes to finding stocks to help a portfolio outperform. It hasn’t been easy lately and my trading group has made adjustments necessary to continue to profit in the current environment. A tweet I sent last weeks sums up adjustments that need to be made:

“Coming from a guy who has spent 10+ years picking stocks and swing trading via options. This is not an environment you will thrive in. It probably isn’t your skill in stock picking that’s the problem. It will only be your fault if you continue to trade this way.”

If you wish to be more active, here are the main adjustments that should be made with respect to options swing trading:

- Less positions. My personal rule in regular market conditions has been 5 positions. I have reduced this to 3 or less. Swing trading by definition involves holding options overnight. We want minimal overnight exposure in a highly correlated environment which is at the mercy of a headline.

- Smaller size. If you used to trade 3% of your account size per position, back it off to 1.5%. This goes back to exposure and we want less of it.

- Daytrading if you have the means to do so. There are special occasions where I can recommend short term trading and headline driven markets are one of them. Weekly options, stocks and futures in which you are both in and out the same day. This requires a different system but the same principles are always at play. Manage risk on lower timeframes and try to catch the momentum stock of the day.

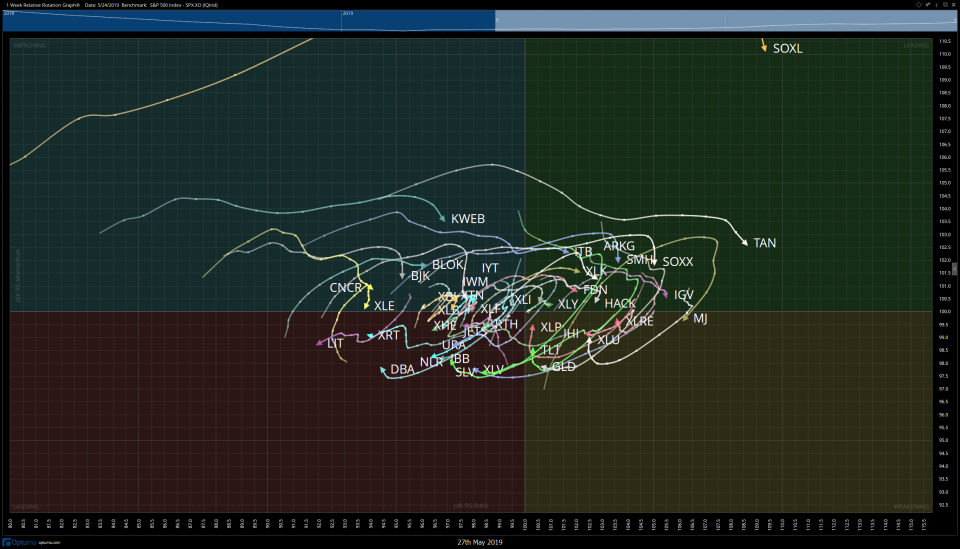

All of that being said, I will lay out my favorite setups, free of the usual risk/reward table and you will see the type of setup that is holding up well in this environment. Before we get to that, here is the week’s RRG:

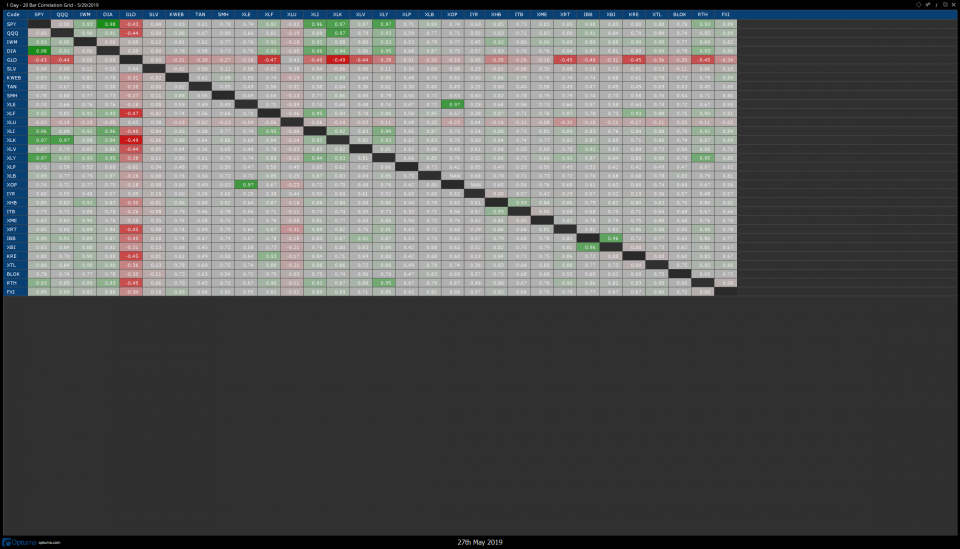

Further to the RRG, Optuma allows us to create a Market Correlation Grid like the one seen here:

I haven’t talked about Correlation Grids in the past but this is a tool I use to manage my long term investment accounts. The above is a rolling 20 day correlation grid among some different asset classes and equity sectors. I will be talking more about these in coming weeks and don’t hesitate to ask if you have questions on how to use these.

Favorite Setups For Short Term Positive Alpha:

- ARNA

2. KBR

3. MAN

4. SBGI

5. WIX

You can see the theme. Pull backs in uptrends, often supported by initiative candles on heavy bullish volume. This shows that strong hands are involved and that they will defend prices from below.

Let’s have a great last week of May and I will see you all next week!

Trent J. Smalley, CMT