As expected you were awarded your .25% rate cut. Shortly after as predicted, you got a knee jerk sell the news event which served to drive equity indexes lower. The first reaction to such events is nearly always wrong. The sell off was nothing more than a short term, door buster sale that gave you a chance to buy a quality stock or three at a discount. I hope you were able to do so.

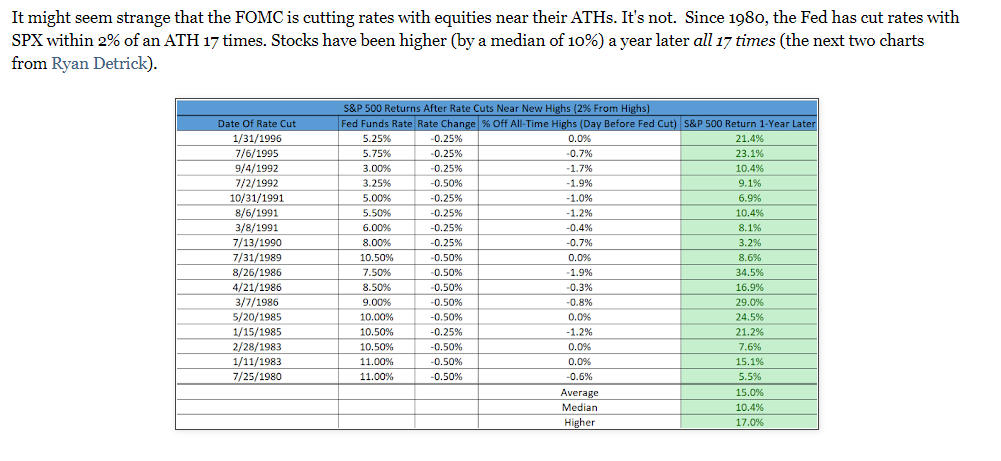

Not surprisingly the Fed’s decision to cut rates was met with the same overplayed vitriol that has plagued this bull market all year. Less surprising yet was the negligence of rigor when it comes to doing your homework on how stocks react to such events. That’s okay, I’ll pick up the slack for you and courtesy of Urban Carmel and his outstanding blog “The Fat Pitch” give you a picture since I know you like those:

At first it didn’t seem “normal” that a rate cut would come at a time when a few major stock market indexes are at all time highs. Turns out it’s not out of the ordinary at all. The Fed doesn’t cut rates because it wants the US Stock Market to go higher. I’ll let you do some research on Fed Policy and their overall responsibility. My goal was to find you the facts on what happens to the S&P 500 in the following year following a rate cut within 2% of all time highs.

Puzzle over that chart above and make an educated decision with what to do with your money. While we never know for sure what the next year will bring, it’s always better to arm yourself with the facts instead of listening to hearsay or opinionated voices telling you “what they think.”

Good luck.

Trent J. Smalley, CMT